Posts

https://baysourceglobal.com/wp-content/uploads/2013/04/boardroom.jpg

400

495

David Alexander

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

David Alexander2016-09-10 12:26:002018-11-28 18:44:41Using a China Agent vs Going Direct

https://baysourceglobal.com/wp-content/uploads/2013/04/boardroom.jpg

400

495

David Alexander

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

David Alexander2016-09-10 12:26:002018-11-28 18:44:41Using a China Agent vs Going Direct https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

0

0

David Alexander

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

David Alexander2016-06-14 16:41:082018-11-28 18:47:23What's Next for Manufacturing in China?

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

0

0

David Alexander

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

David Alexander2016-06-14 16:41:082018-11-28 18:47:23What's Next for Manufacturing in China? https://baysourceglobal.com/wp-content/uploads/2013/10/solidworks2.jpg

162

311

David Alexander

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

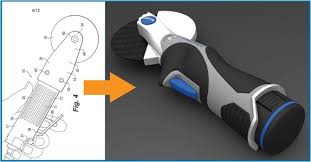

David Alexander2016-04-01 12:55:252018-11-28 18:48:00New Product Development and The Adaptation Curve Part I

https://baysourceglobal.com/wp-content/uploads/2013/10/solidworks2.jpg

162

311

David Alexander

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

David Alexander2016-04-01 12:55:252018-11-28 18:48:00New Product Development and The Adaptation Curve Part I https://baysourceglobal.com/wp-content/uploads/2014/07/Segway.jpg

273

185

David Alexander

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

David Alexander2016-02-28 10:20:132018-11-28 18:49:06New Product Development and “The Adaptation Curve”

https://baysourceglobal.com/wp-content/uploads/2014/07/Segway.jpg

273

185

David Alexander

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

David Alexander2016-02-28 10:20:132018-11-28 18:49:06New Product Development and “The Adaptation Curve” https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

0

0

David Alexander

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

David Alexander2016-01-04 15:37:222018-11-28 18:50:24Playing Football in the Rain

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

0

0

David Alexander

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

David Alexander2016-01-04 15:37:222018-11-28 18:50:24Playing Football in the Rain https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

0

0

David Alexander

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

David Alexander2015-11-06 13:17:442018-11-28 18:52:48A Community of Opportunity

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

0

0

David Alexander

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

David Alexander2015-11-06 13:17:442018-11-28 18:52:48A Community of Opportunity

Down on China? Not so fast

Thanks to mega contract with China, local company to add 100 jobs

A Conversation on Doing Business in China

“China remains the low cost factory of the world today and will continue as such for many years,” speculates featured panelist David Alexander of BaySource Global

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

0

0

David Alexander

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

David Alexander2014-06-18 15:19:542018-11-28 18:58:44Instead of worrying about China, companies are better off embracing the opportunities.

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

0

0

David Alexander

https://baysourceglobal.com/wp-content/uploads/2013/04/BSG-new-logo-large1-e1426014540772.jpg

David Alexander2014-06-18 15:19:542018-11-28 18:58:44Instead of worrying about China, companies are better off embracing the opportunities.