As a company plugged into the ecosystem of New Product Development we are fortunate to see a new idea for a great product almost every week. Admittedly some fall into the “Why didn’t I think of that” category while others seem more limited in potential. In both cases there is one key element missing 95% of the time and that is research. Research leads to a plan. Sometimes this roadmap leads to an impasse like a mountain range on an expedition. Other times it reveals a small but certain path to success if followed and measured by each step.

Inventors and new product developers usually fall into two categories—those with the Eureka moment of inspiration and those with pragmatic vision and instinct to see what next great opportunity exists. Both are blessed with creativity but only a few are successful in taking their idea to marketable concept. Why? Most inventors spend a disproportionate amount of time, resource and capital on product development, manufacturing and cost without first doing the necessary research and analysis on the product’s market potential. Furthermore they lack a business plan and budget for getting their product into appropriate retail channels. Following are four overlooked steps to success in launching a new product.

Understanding Patent & IP Protection vs. First to Market

An entire book could be written on the merits of weighing protection of intellectual property vs. being first to market. The time and expense of applying for a patent are daunting. Many become paralyzed when they believe their product launch is hostage to receiving a patent. In 2013 the first to file provision morphed into the First to Invent under the 2011 America Invents Act which provides a grace period by which products are reduced from an “application” to practice. If an inventor can demonstrate due diligence such as showing a product at trade shows, preparing prototypes and sending out sales samples he/she will have dominion over the invention.

What this means for everyone is that they need to be taking steps toward getting feet on the street and being first to market. The innovation that intersects with opportunity, demonstrates value and provides a new and better mousetrap is the one whose brand equity gets the head start. The single greatest omission we see frequently is inventors not adequately budgeting for selling activities which means planes, trains and automobiles. There is expense and time involved with creating collateral material, a web site, participating in tradeshows, traveling to buyers’ offices, meeting with distributors (an entire topic on its own) and creating and executing a sales & marketing calendar.

Retail Landscape

Products fall into hundreds of categories such as health and fitness, hardware, DIY, home improvement, etc. The marketplace is a vast, ever expanding and complex territory to navigate. In addition to Big Box or brick and mortar, the internet will be involved in more than 60% of retail sales by 2017 and will climb with the use of mobile such as smartphones and tablets. While this may seem to open up even greater opportunities to sell products, an internet strategy requires an entirely new set of disciplines and skills for selling and fulfillment.

Furthermore, inventors who have a new weed killer device or pooper scooper may have never worked with or sold to lawn & garden or pet buyers. Consider also that depending on the retailer, responsibility for multiple categories may fall under one manager. Does your contacts list include retail buyers? You might consider using brokers who have relationships at retail and can combine your single line item SKU with others they represent.

Reality vs. The Universe

Here is yet another breakdown in analysis and planning occurs. Some inventors invest their life savings—up to six figures attempting to see their product come to life. The reality is it is difficult to capture a substantial percentage of the potential category or market for a product in the first year of sales. A break even analysis can serve as a forecast or budget which will tell you how many widgets you will need to sell on an annual basis to recover your outlay and total investment.

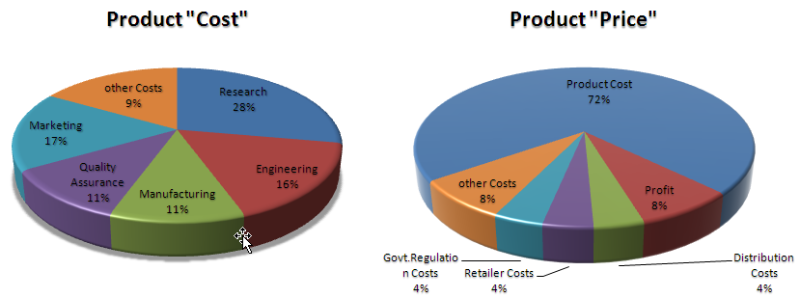

This isn’t true just for inventors. Product managers are expected to create pro-formas based on empirical data rooted in research and facts. The first thing they analyze is suggested retail price (SRP) what the market will bear. Working backward they deduce what their wholesale cost needs to be which then leads to manufacturing and landed cost targets. Included also are startup costs such as tooling, prototypes and samples.

China, Inventory and MOQs

Many turn to China to have their products produced. When approaching suppliers the better you can demonstrate a well thought out plan the more credibility you will have. A documented Request for Proposal (RFP) is the first step toward building this credibility with potential factories. Engineering drawings, material specifications and guidelines for “fit and function” should be clear. They may in turn ask questions about how you plan to be successful with your product and want to better understand your game plan. China is inundated with requests for quotations. Unless you are an established entity it may be difficult to be taken seriously or with a sense of urgency. Sometimes it makes sense to hire an agent who already has established relationships in place, can monitor the project and be on hand for product changes and quality control concerns.

Another example of putting the cart ahead of the horse is predicting the capital requirements for that first order. Surprisingly we see many who have put months of work into their projects without yet having their finances in place for initial orders. Minimum order quantities (MOQs) can begin around $25K on the low side and up to $100K for the first purchase order. The last thing you want is capital tied up in slow moving inventory.

Preparation, homework and analysis is key. Done properly and well ahead of time will reveal the “Go-No Go” decision providing a framework for success.

Follow Us