In 2016 China implemented its One Belt, One Road global development program with the goal of making China the world’s dominant economic power. In 2018 the US imposed tariffs on Chinese imports to retaliate for what the US regarded as unfair business and trade policies in China. One of the unstated effects of US tariffs was to incentivize our businesses to either bring their manufacturing back into the US or move factories to other Asian countries. Many economists believe US tariff policy is a none-too-subtle response to China’s One Belt, One Road gambit. Under this theory, tariffs are understood to be a tip of the American spear aimed at achieving the more important US policy goal of decoupling US economic integration with China more generally.

Over the past decade, US manufacturers built low-cost manufacturing and supply chain partnerships in China. Now they are dealing with pressures from the US government to pivot out of China and create partnerships in other Asian countries and even move back and build factories in the US.

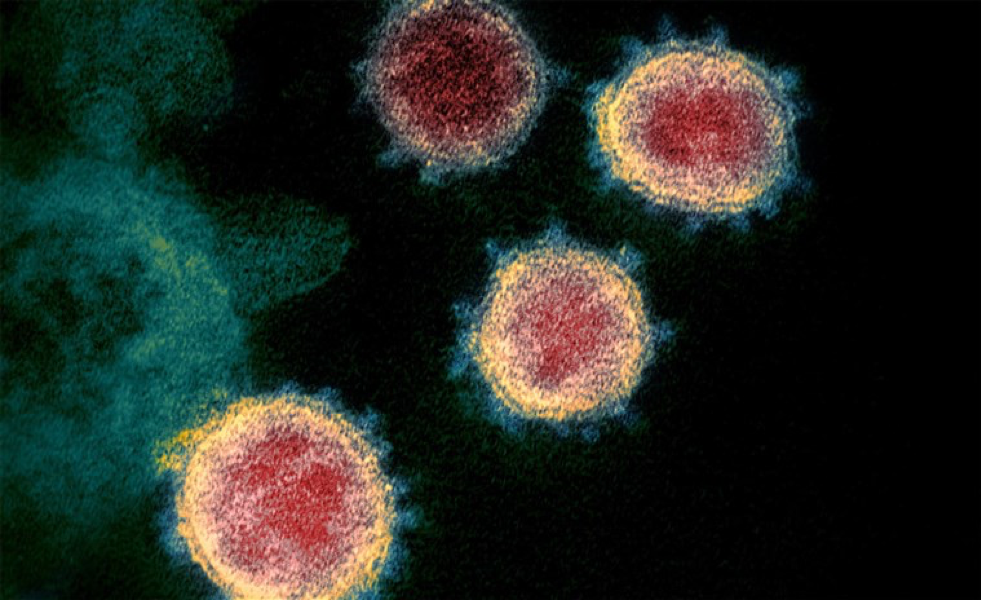

Electron microscope image of coronavirus emerging from human cells

A Broken Supply Chain with China?

Complicating the intersectionality of the battle between US and China for economic supremacy is the coronavirus pandemic. Scientists found the origins of coronavirus lurking in an exotic animal known as the Pangolin which is sold for human consumption at Chinese markets. After the flu-like virus first surfaced in December 2019 in Wuhan Province, it quickly spread into a worldwide pandemic.

In the early weeks of the pandemic, China suffered a major economic hit. Chinese GDP may plunge from 6.1% in 2019 to 1% in the first quarter of 2020. The US response banning travel from China into the US hurt Chinese economic growth. Within China itself, virtually every link in the global supply chain has been disrupted by Chinese government-directed quarantines and lockdowns affecting half of China’s population (750 million people). US manufacturers were forced to think seriously about finding new sources of supply elsewhere in Asia. Remember, the previous year’s trade war had already been nudging US companies in that direction before the virus hit.

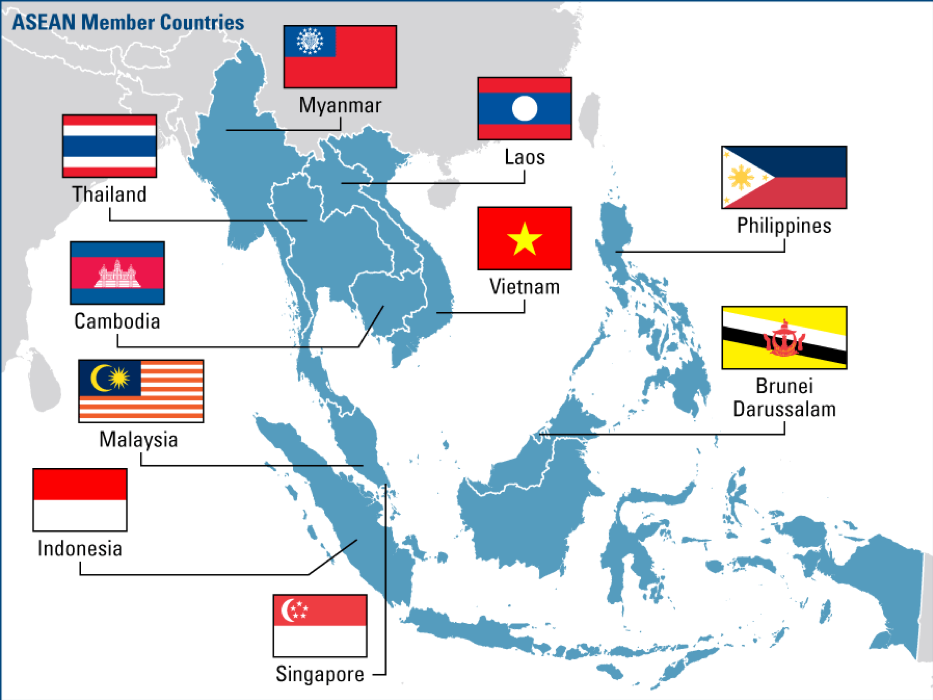

The 10 countries that make up ASEAN

There’s No Place to Hide

Japan, and South Korea are fully integrated trading partners with China but are suffering severe disruptions in their Chinese supply chain relationships because of coronavirus cases in their countries. These Asian economic giants were being considered by US companies as possible trading partner alternatives to China. Now, as the pandemic moves into a “community spread” phase with new infections, no one knows which country in Asia could be next to suffer economically devastating consequences, thanks to the health and mortality risks from the COVID 19 virus. US businesses are reluctant to sever long-standing supply relationships in China and risk disruptions in some other Asian country that is hit by the virus.

Nothing about the evolving US-China trade relationship has clarity except this: The coronavirus and trade tariffs have created a new landscape for US-China trade that will reveal itself later this year in 2020.

China is planning a massive response and will be deploying its considerable resources to deal with the virus pandemic by aggressively implementing business tax reductions and incentives for its businesses. It will avoid mass exodus of US businesses because that would threaten its long term One Belt, One Road ambitions.

China’s central command economy has the ability to reallocate resources, reduce small business taxes and create other incentives to continue expansions of its global supply chain. But the perceived complexities of doing business in China mean decision-makers will continue to take a hard look at ASEAN competitors in the wake of the pandemic crisis. All this said China will likely a preeminent supply chain destination.

Contact Us

Follow Us