Today, business decisions are played out in an unpredictable global economic environment. The international landscape comes with risk from trade wars and recently, coronavirus. CEOs who own manufacturing companies in the US enter that environment with full knowledge that managing risks to their supply chain in today’s world of trade tariffs and epidemics requires agile partnerships.

China’s first quarter GDP figure will have a downward revision from over 6% to perhaps as low as 1% when it was finally reported early in March. Some economists are predicting a first-quarter economic growth contraction. The ultimate resource for an agile response to unexpected existential crises like those erupting in China, requires competent eyes and ears on the ground half-a-world away.

The coronavirus epidemic which originated in China’s Wuhan city has already infected nearly 90,000 within China and accounted for almost 3,000 deaths (as of 3/2/2020). Factories are shuttered and workers quarantined. US companies are measuring their losses in the billions of dollars. SME board rooms are monitoring strategies and looking for guidance from the giant manufacturers like Apple, which closed all 42 of its stores in China. Apple’s loss comes not only from a decline in sales of its iPhone 9 within China, but Apple was hit with losses from the disruption of supply for its global sales outlets as well. Its share-price lost $45 billion in one day. Starbucks and Ikea have closed stores because workers are quarantined and can’t get to work. Automakers in China are shuttering their assembly lines due to lack of parts from Chinese suppliers.

Question: ‘Get Outta Dodge’ Strategy in China after Coronavirus?

US companies planning for the post-coronavirus environment are considering the full spectrum of options. One of the strategies being considered is the so-called nuclear option. Should they look for a China-alternative for their post-coronavirus sales and supply chain? Retreat from China seems to be a wildly extreme reaction based on the advice of many leading health experts who see the epidemic as a short-term crisis.

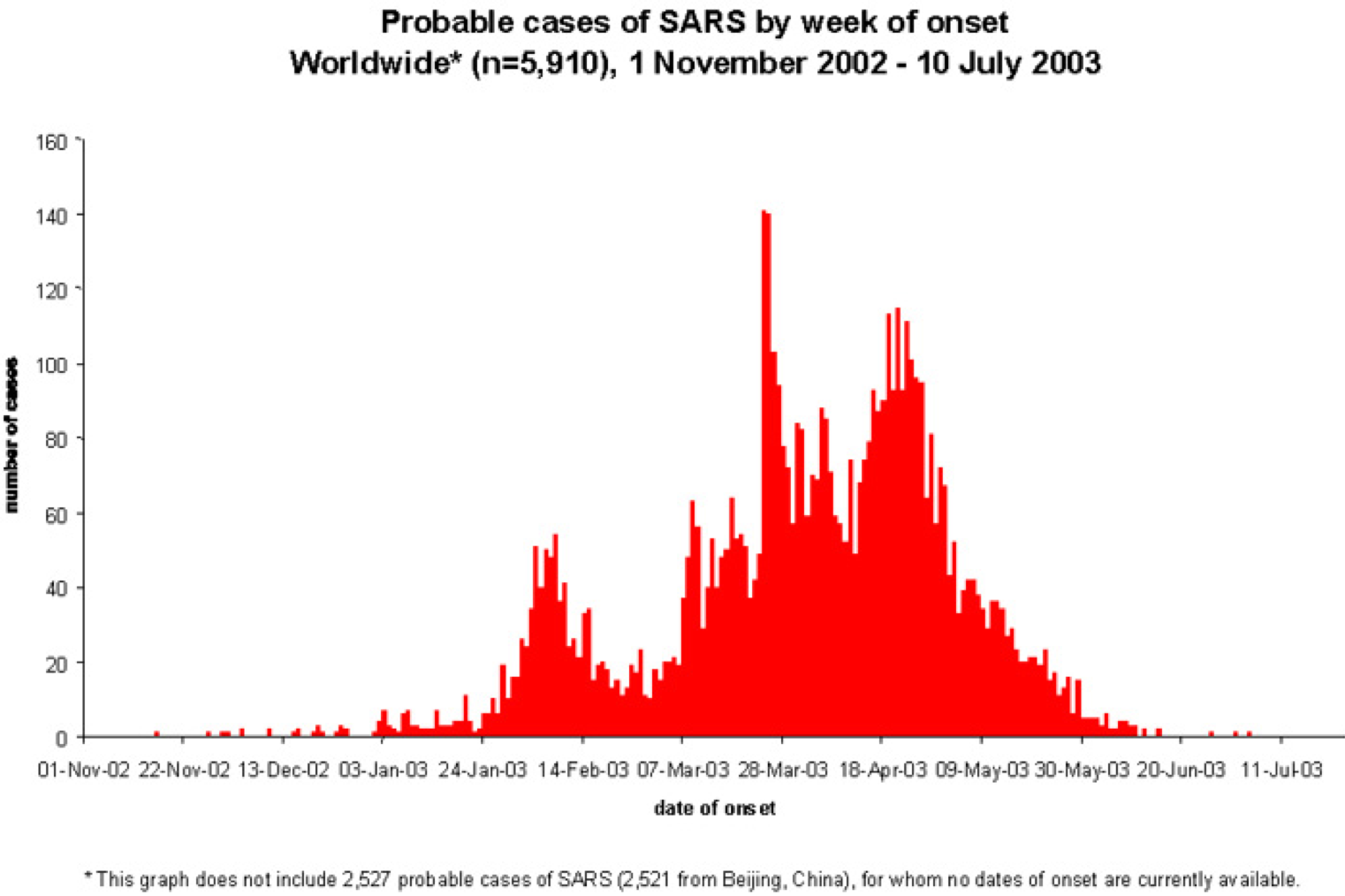

Click picture for link to chart on WHO webpage

In the previous SARS epidemic, which also had its origins in China. infections spread in January 2003 but then declined and were on their way out by May of that year. Quarantines and travel restrictions defeated the SARS virus in 2003,

The human landscape in China’s winter season is like a petri dish for human to human transmission. Scientists expect flu-like epidemics, such as the coronavirus, to die out in warmer weather. COVID-19 (Coronavirus) Is not new. It accounts for one-third of common colds recorded this winter. Dr. Anthony Fauci, said “It’s not unreasonable to make the assumption” that Coronavirus cases will die down come Spring.”

Best Coronavirus Strategy? Opportunities in Post-epidemic China

China’s Premier Xi has ordered tax cuts and lower fees for businesses hit by the epidemic. He wants banks to provide more credit to support companies struggling in the recovery phase from the Coronavirus.

The question of how to prepare for the post-coronavirus environment in China and throughout the world is top-of-mind for businesses who have a Chinese-based supply chain or sell to Chinese consumers. Those who have listened to Dr. Fauci are looking at the post-coronavirus landscape in China for opportunities. The return to normalcy is looked on as an opportunity for better relationships with suppliers and retail partners alike in China. Thought leaders and influencers are planning their post-epidemic strategy in anticipation of the transition back to normalcy. There are benefits from proactive business strategies which anticipate opportunities and seek value proactively where others see risk and choose an exit strategy.

To stay up to date on the most recent numbers associated with the coronavirus cases, deaths, and recoveries worldwide please click here.

Contact Us

Follow Us